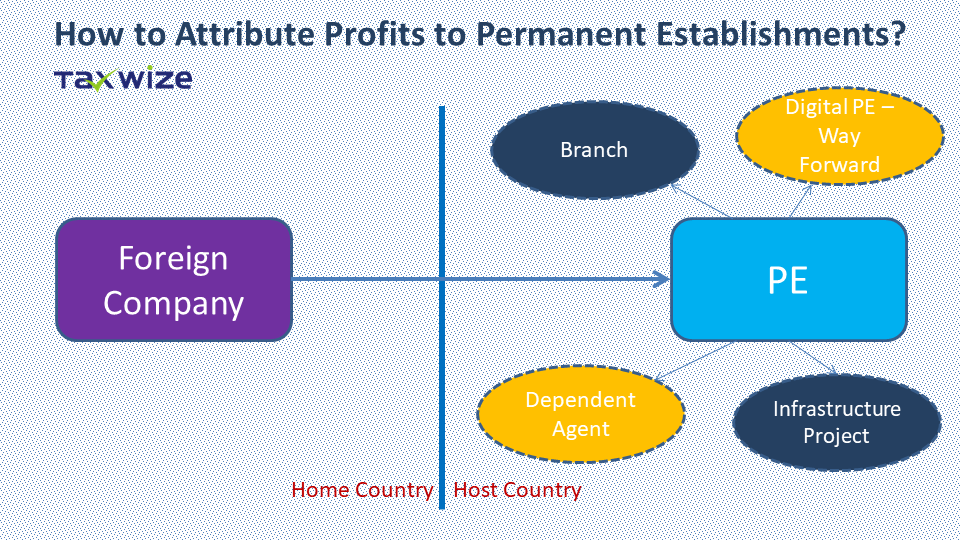

In BEPS Action 7 the OECD has recommended changes to Tax Treaties to prevent Artificial Avoidance of Permanent Establishment (PE) Status. Those changes will be made through Multi-Lateral Instrument (MLI). Among other things, the changes make the criteria for formation of Dependent Agency PE stricter. Same is the situation even under the Indian Domestic Law – New clause (a) has been inserted w.e.f. 1-4-2019 in place of the old clause (a) of Explanation 2 to section 9 (1)(i) of the Income Tax Act, 1961.

Read more...

These are uncertain times; these are exciting times. We are stepping out of the Old; we are stepping into the New. The path of taxation, a path on which we walk with undying enthusiasm, is bending ahead. Beyond the bend lies the new world of taxation, a world inhabited by BEPS, MLI, PoEM and GAAR. Of these, the GAAR truly is intimidating, standing – sternly – in the way of tax planning, compelling us to instill an element of caution in all our tax planning ventures. Unless we equip ourselves to deal with the challenges posed by GAAR, unless we understand how GAAR affects tax planning, we will not succeed in serving those who, with such reverence, rely on us to take care of their tax matters.

Read more...

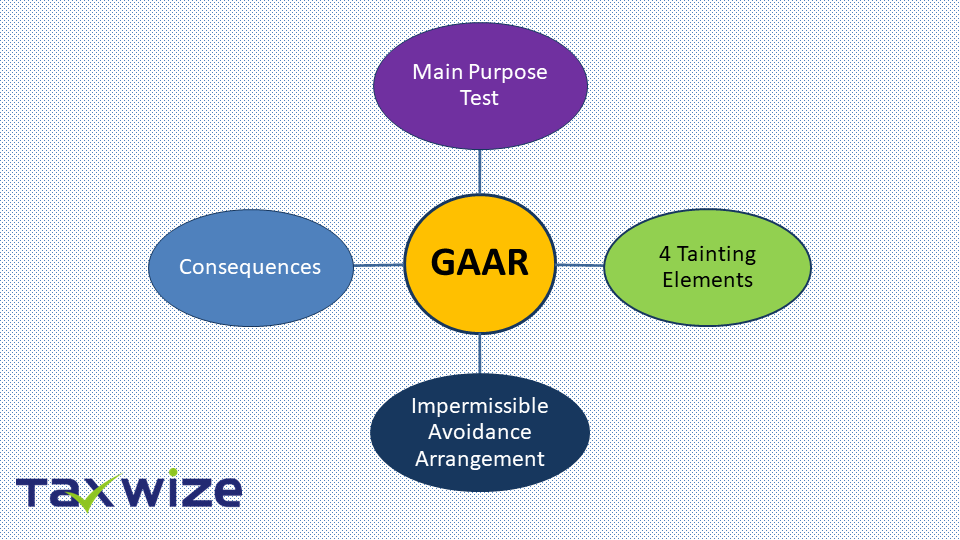

Imagine you have arranged loan for your Company, and the Tax Authorities determine (please see Para 4 below for situations in which the Authorities may do so) that the loan-arrangement is not permissible under General Anti-Avoidance Rule (GAAR). What are the consequences?The Assessing Officer is granted authority (Sec. 98 of Income Tax Act 1961) to re-characterise the Loan (Debt) as Equity and can, by virtue of that authority, re-characterise Interest paid by your Company as Dividend payout. As a result,

Read more...

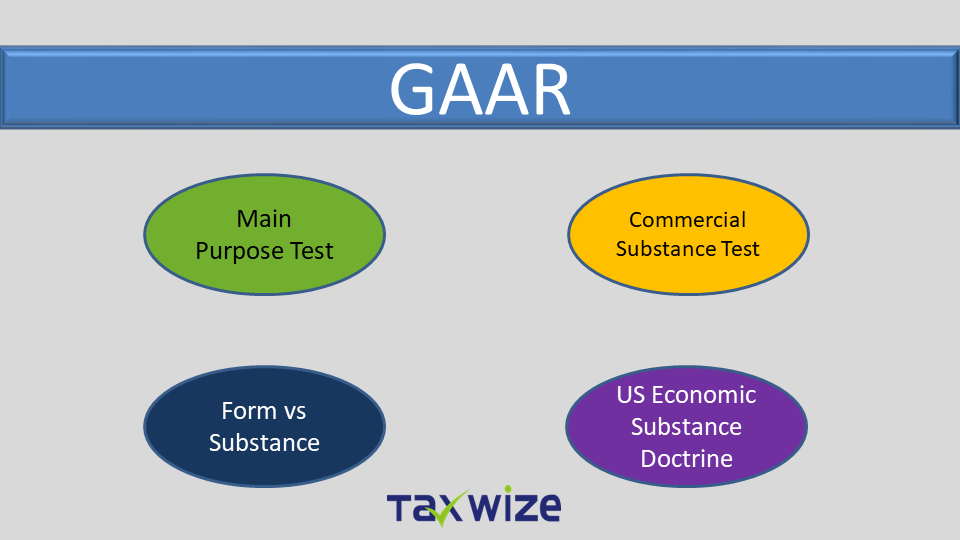

The Indian GAAR (General Anti-Avoidance Rule) has codified the doctrine of Substance-over-Form. Lack of Commercial Substance – somewhat similar to the US Economic Substance Doctrine – is one of the four Tainting Elements specifically listed under Indian GAAR. Under the US Economic Substance Doctrine read with the Step Transaction Doctrine – an instructive case (Barnes Group, Inc. and Subsidiaries, T.C. Memo 2013-109) was decided by the US Tax Court in favour of the IRS – that case was upheld by the US Court of Appeals (Second Circuit) in Barnes Group, Inc. and Subsidiaries vs CIR No. 13-4298 (2d Cir. Nov. 5, 2014). That case gives an insight into when, under the US Economic Substance Doctrine, can a loan be treated as dividend.

Read more...

Should a Taxpayer be allowed the benefit of set-off of loss, arising from a transaction, without actually suffering any economic loss? What is relevant for purposes of taxation: Form of the transaction or its Substance?In the era of GAAR the answers to these questions are obvious from the statutory provisions – the answers will be against the Taxpayer and in favour of the Revenue. But in the Pre-GAAR era the Supreme Court answered in favour of the

Read more...

In case of Wipro Ltd [CIT vs Wipro Ltd [2014] 50 taxmann.com 421 (Karnataka)/[2014] 227 Taxman 244 (Karnataka)(MAG.)] the Karnataka High Court, in the Pre-GAAR era, rendered an arrangement to manufacture capital loss as an Impermissible Avoidance Arrangement. Though, in the case of Wipro Ltd the High Court pronounced its verdict before GAAR came into force the High Court’s verdict is worth looking at even in these days of GAAR.

Read more...

This is a case where GAAR (General Anti Avoidance Rule) has struck – unexpectedly – beyond its striking range; and that too, long before its due-striking-date.Can you believe that, even in a situation where GAAR does not apply, the NCLT has accepted the Income-Tax Department’s claim that GAAR applies? Can you imagine that GAAR has succeeded in prohibiting a Scheme of Merger that was to take place long before GAAR even came into force? Incredible!

Read more...

The Financial Year 2015-16 saw a lot happening in the ever-changing field of Transfer Pricing in India. We have put together a Presentation on 15 recent High Court Judgements (pronounced in 2015-16) on Transfer Pricing – in some cases the High Courts have reversed the rulings of Tribunal, while in others the rulings of Tribunal have been confirmed.

Read more...

Got an opportunity to Speak at the All India Conference of Transfer Pricing Officers, on 3rd May 2016. A variety of Topics were discussed at the Conference. Views of the Officers were expressed. At the same time the views of Taxpayers too were presented. Competent Authority (International Taxation) of India, Director General of Income Tax (International Taxation) and other Senior Authorities enlightened the Delegates.

Read more...

In the previous Post I had posted Part I of our Budget Presentation covering Transfer Pricing and International Taxation. Now I share Part II (Domestic Corporate Direct-Tax Proposals). In Part II we present, among other things, the following aspects of Budget 2016

Read more...

India had strongly backed the OECD BEPS Project. So, we were keen to see what BEPS recommendations India would implement in the recent Budget. On 29 February 2016 – when the Budget 2016 was declared – we found that three Action Plans of BEPS will now become a part of the Income Tax Law of India: Action Plan 1 (Digital Economy), Action Plan 5 (Nexus approach to favourable R & D Regime), and Action Plan 13 (New Transfer Pricing Documentation: Country-by-Country Reporting and Master File).

Read more...

The payment of Management Service Fees (‘MSF’) is a necessary modern day feature of Multinational Companies (‘MNCs’). Centrally coordinated services are required by MNC Group entities in order to maintain global standards, quality, competitive edge, confidentiality, etc. and also to reduce cost.

Read more...

Consider this case. An Indian E-Commerce Company (say, India E-Com Ltd) partly develops valuable Intangible (unique software to conduct and manage online retail business) for e-commerce, through in-house R & D. India E-Com Ltd transfers the partly-developed software to its Ireland Subsidiary for a lump sum consideration. The intangible in the form of partly-developed software is hard-to-value. That is because of these reasons: (i) the software is expected to be exploited in a novel manner, and (ii) the future projection of earnings is highly uncertain due to absence of a track record of development or exploitation of similar intangibles.

Read more...

Participated last week on 24-25 September at the Global Transfer Pricing Forum 2015 (Washington DC), as a speaker on India Panel. With me on the India Panel were Douglas O’Donnell (US IRS Commissioner – Competent Authority of USA for resolution of disputes under Tax Treaties), Akhilesh Ranjan (Indian IRS Commissioner – Competent Authority of India for resolution of disputes under Tax Treaties), and Sanjay Kumar (Senior Advisor, Deloitte).

Read more...

In first week of this month (on 6th July 2015) the OECD held Public Discussion on the Discussion Draft on Hard-To-Value-Intangibles (HTVI) – the Discussion Draft was released by the OECD on 4th June 2015 under BEPS Action 8 (HTVI).What is a HTVI? What are OECD’s key recommendations on arriving at the Transfer Price of HTVIs? What practical implications will the OECD’s recommendations have? And how can the OECD improve its recommendations? You will, hopefully, find Answers in this write up.

Read more...

Commodity transactions, both exports and imports, are quite common between Associated Enterprises (AEs). These transactions have one distinct feature: the prices are quoted in public on reputed Commodity Exchanges (e.g. London Metal Exchange, Chicago Board of Trade, Multi Commodity Exchange of India, Malaysian Palm Oil Board, etc.) and published by reputed Price Reporting Agencies (PRAs – like World Oil, Argus, Platts, Bloomberg, etc).

Read more...

You might know this. To compute Arm’s Length Price, under Resale Price Method (RPM), Cost Plus Method (CPM) and Transactional Net Margin Method (TNMM), we use a Profit Level Indicator (PLI), to compare profitability of either the Taxpayer or its Associated Enterprise (the Tested Party) with that of Comparables. The PLI that we use with RPM is the ratio of ‘Gross Profit (GP)/Sales’; with CPM it is ‘GP/Cost’. And with TNMM the PLI is one of these three ratios: ‘Operating Profit (OP)/Sales’ or ‘OP/Cost’ or ‘OP/Assets’.

Read more...

In his budget speech, the Finance Minister, had conveyed the decision of the Government to enact a comprehensive new law to specifically deal with black money stashed away abroad. He also promised to introduce the new Bill in the current Session of the Parliament.Today the Government introduced the Undisclosed Foreign Income and Assets (Imposition of Tax) Bill, 2015 – popularly known as The Black Money Bill – in the Parliament.

Read more...

In the Budget 2015 presented by Hon. Finance Minister on 28th February 2015 significant changes have been made in the area of International Taxation. Those changes will have strong impact on Foreign Direct Investment (FDI), Foreign Portfolio Investment (FPI) and Cross-Border Technology Transfers, in the coming years.In the Presentation below we focus on International Taxation proposals of the Budget 2015. Dear Reader, to You we bring, among other things, answers to several important Questions in the area of International Taxation.

Read more...

The Delegates were quite enlightened; their active participation breathed life into the entire Workshop. All in all, a fulfilling experience.

Read more...

Two days back, on 10 December 2014, these questions were answered by ITAT Mumbai in favour of the Revenue, in the case of Vodafone India Services Ltd (the Taxpayer). The ITAT Mumbai has, thus, upheld Transfer Pricing adjustment in excess of Rs. 6000 Crores, made by the Revenue.

Read more...

On November 18, 2014 the Bombay High Court pronounced its verdict in the famous Shell India share issue (Transfer Pricing) case [Shell India Markets (P.) Ltd vs ACIT, LTU [2014] 51 taxmann.com 519 (Bombay)]. In that Case the Taxpayer (Shell India) had issued 85.88 Crores equity shares to its Non-Resident Associated Enterprise (AE) at face value of Rs.10 each. But the Transfer Pricing Officer (TPO) determined the Arm’s Length Price of shares at Rs. 183.44 per share. Based on that determination, the TPO made Transfer Pricing adjustment of Rs.15,220 Crores.

Read more...

Every Professional will benefit from reading and referring to this essential Book. It contains several Case Studies, Specimens (of Transfer Pricing Study Report and Report in Form 3CEB), Practitioner’s Check Lists, Practical Examples, Latest Case Law, and in-depth Analysis of about 50 Issues confronting the Taxpayers.

Read more...